Gross vs Net: Decoding the Real Value of Your Money

Gross vs Net are common concepts often misconstrued. Gross and net figures are everywhere, in salaries, business reports, and even personal budgets. Yet, many people misunderstand their true impact. Gross numbers show the big picture, but net numbers tell the real story. From company revenues to personal earnings, knowing how to differentiate between the two is key to financial clarity. If you’ve ever struggled to understand why your salary doesn’t stretch as far as you imagined, or why businesses report millions in revenue but barely make a profit, the key is to know your net vs gross income, and how Bycard virtual cards can be helpful in managing those earnings, however this article will give clarity.

What is Gross Income?

“It’s not about how much you make, but how much you keep.” — Robert Kiyosaki

Think of gross income, or gross earnings as your paycheck before life happens to it. It’s the total money you earn before deductions like taxes, insurance, and pension contributions take a bite.

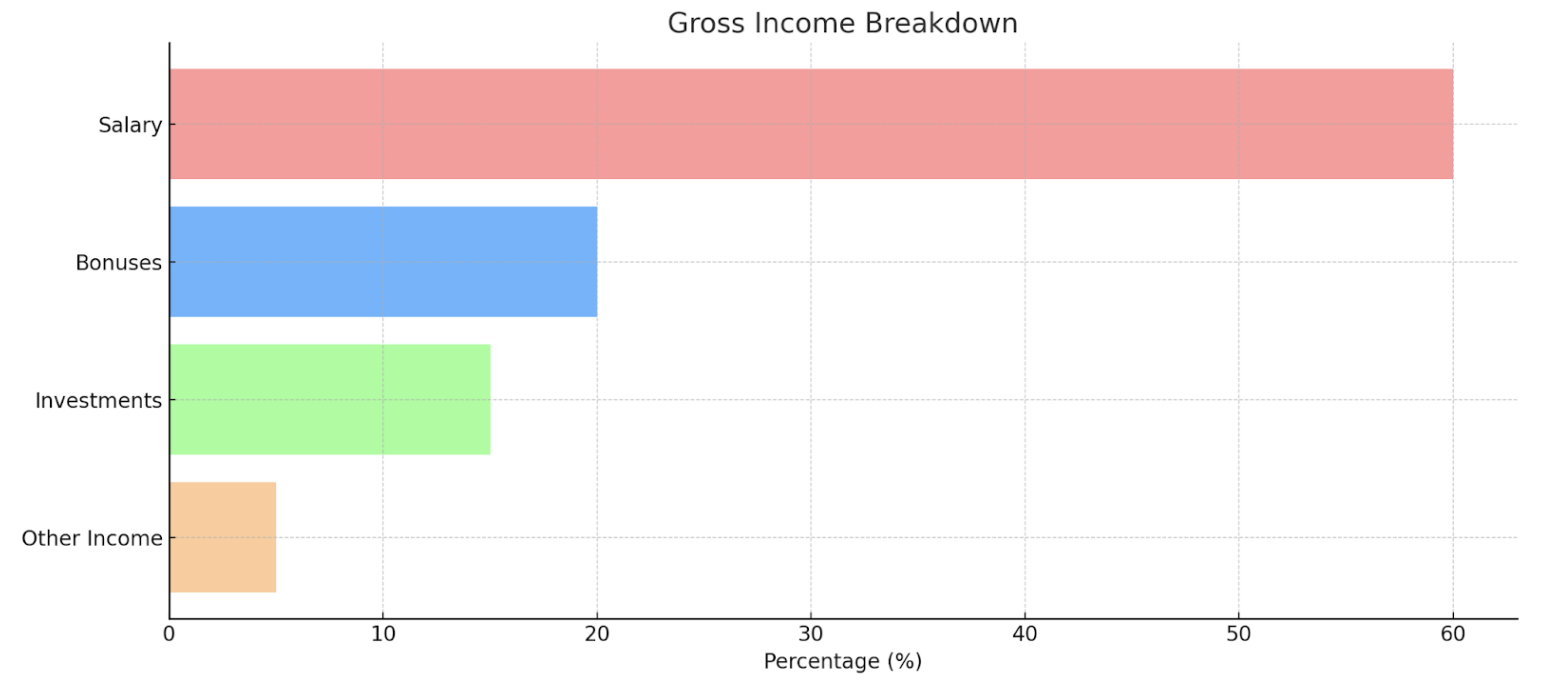

For individuals, this includes:

✔️ Your base salary

✔️ Bonuses and commissions

✔️ Overtime pay

✔️ Any other earnings before deductions

For businesses, gross income is the total revenue before deducting expenses. It’s what a company earns from sales before considering costs like salaries, rent, and operational expenses.

Example: If you’re earning $10,000 a month, that’s your gross salary. If a business generates $600,000 in sales before expenses, that’s its gross revenue.

What is Net Income?

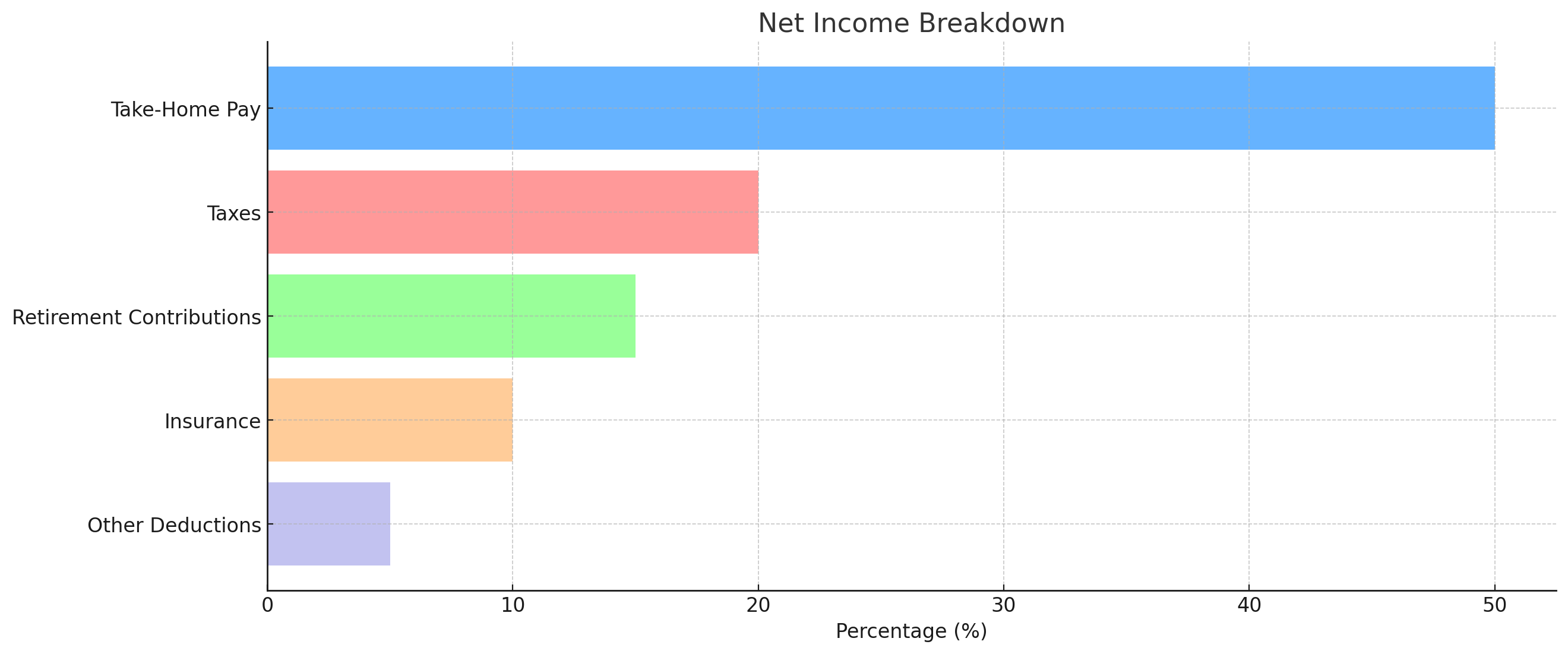

Now, here’s where reality kicks in. Net income is what you actually get to keep from your gross earnings after deductions. It’s your real take-home pay or, in business terms, the actual profit after expenses.

For employees, net income is the money left after:

✔️ Taxes

✔️ Health insurance

✔️ Pension contributions

✔️ Other deductions (loan repayments, garnishments, etc.)

For businesses, net income is what remains after deducting:

✔️ Operating expenses

✔️ Employee salaries

✔️ Taxes

✔️ Other financial obligations

Example: If your gross salary is $5,000 and after taxes and deductions you receive $3,800, that’s your net income. If a business makes $500,000 in revenue but has $400,000 in expenses, the net income is $100,000.

The Key Differences Between Net Income vs Gross Income

Many people mistake gross income for their actual earnings, only to be surprised when they take home much less. The distinction between net income vs gross income is fundamental in finance, whether for salary negotiations, business revenue, or tax planning. Knowing this difference can help you budget better, plan investments, and make informed financial decisions.

| Aspect | Gross Income | Net Income |

| Definition | Total earnings before deductions | Earnings after deductions |

| For Employees | Salary, bonuses, commissions | Take-home pay after taxes & deductions |

| For Businesses | Revenue before expenses | Profit after expenses |

| Taxation | Not yet deducted | Taxes deducted |

| Importance | Shows earning potential | Shows actual financial standing |

Nothing beats a card that works every time

Why Understanding Gross vs. Net Income Matters

Knowing the difference between net vs gross income isn’t just for accountants, it is for everyone. Here’s why:

For Employees:

- Helps you negotiate a realistic salary. Remember to always ask about net pay!

- Prevents budgeting disaster, spending based on gross pay is a trap.

- This makes tax season easier,you won’t be shocked by deductions..

For Business Owners:

- Separates revenue from actual profit

- Helps in pricing and financial planning.

- Ensures accurate tax calculations and compliance

How to Calculate Your Gross and Net

For Employees:

Formula:

📌 Net Income = Gross Salary – (Taxes + Insurance + Pension Contributions + Other Deductions)

Example:

- Gross Salary: $5,000

- Taxes: $800

- Insurance & Retirement Contributions: $400

- Net Salary: $3,800

For Businesses:

Formula:

📌 Net Income = Gross Revenue – (Expenses + Salaries + Taxes + Operational Costs)

Example:

- Gross Revenue: $500,000

- Operating Expenses: $350,000

- Taxes: $50,000

How Bycard Helps Manage Your Earnings Better

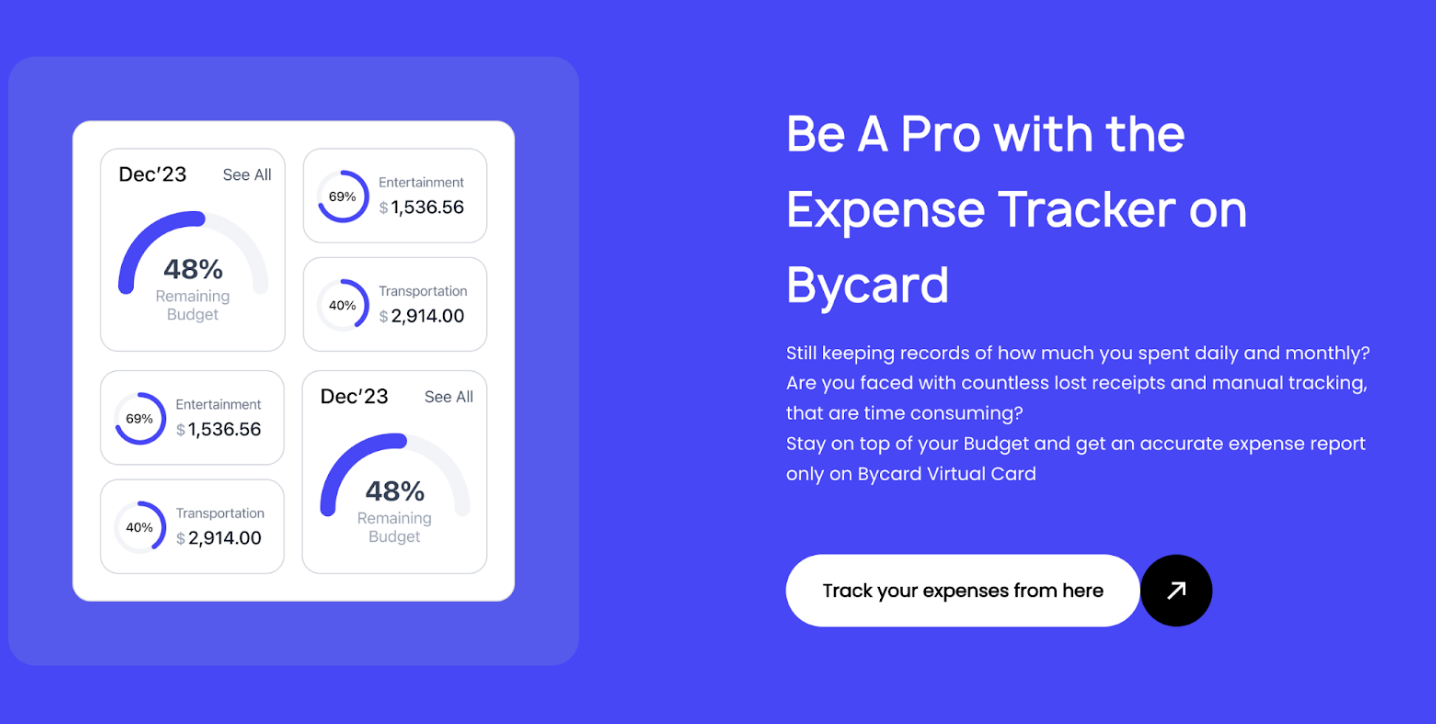

Managing money effectively is just as important as earning it, and requires the right tools. Bycard virtual cards provide an all-in-one financial management solution that helps individuals and businesses track their income, expenses, and budget effectively.

1. Spend Management Tool:

With Bycard’s spend management feature, you can monitor where your money goes in real time. Whether you’re an employee tracking net salary or a business monitoring expenses, Bycard provides automated insights on spending patterns to help you stay on top of your finances.

2. Budgeting and Expense Tracking:

Budgeting is crucial for financial stability. Bycard allows users to set financial goals, allocate funds for different expenses, and track cash flow effortlessly. No more guessing where your money went, Bycard provides a detailed breakdown of income versus expenses.

3. Expense Reports for Better Decision-Making:

Businesses can benefit from automated expense reports that provide real-time insights into profitability and spending habits. Employees and freelancers can generate personal finance reports to optimize their savings and spending strategies.

By integrating Bycard into your financial management, you can:

✔️ Convert income into various currencies seamlessly.

✔️ Make payments and track expenses efficiently.

✔️ Gain insights on spending habits to increase net savings.

✔️ Automate expense reporting for businesses and personal finance.

Nothing beats a card that works every time

Conclusion

Now that you have a better understanding of gross vs. net income, it is easier to transform your finances and prioritize your needs from wants. Gross income sounds great on paper, but net income is what you actually live on. The best and smartest financial decision for individuals and businesses is using Bycard for income tracking, payments, and conversions. Goodbye to the stress of manual calculation and struggling with complex tax deductions and net pay